ANOTHER POSSIBLE STABLECOIN COLLAPSE?

SEC catches Ponzi Scheme creators. A story about a woman, a hitman, and Bitcoin.

Coo! It’s Crypto Owl - the best bird you can find in the woods. Or anywhere.

This Tuesday is National Ice Cream Sandwich Day, so I hope you like it because today’s news will be sweeeet.

On Today's Menu:

🥣SOUP OF THE DAY (ASK THE WAITRESS): USDC, what the HELL?

🥗 BOWL OF GREEK SALAD: SEC Catches Bad Guys Who Created Pyramid Scheme

🍤 FRIED SHRIMPS: A Woman, a Hitman, and a Bitcoin

🍦 ICE CREAM SANDWICH (MANDATORY): More Crypto News Around the Web

USDC, WHAT THE HELL?

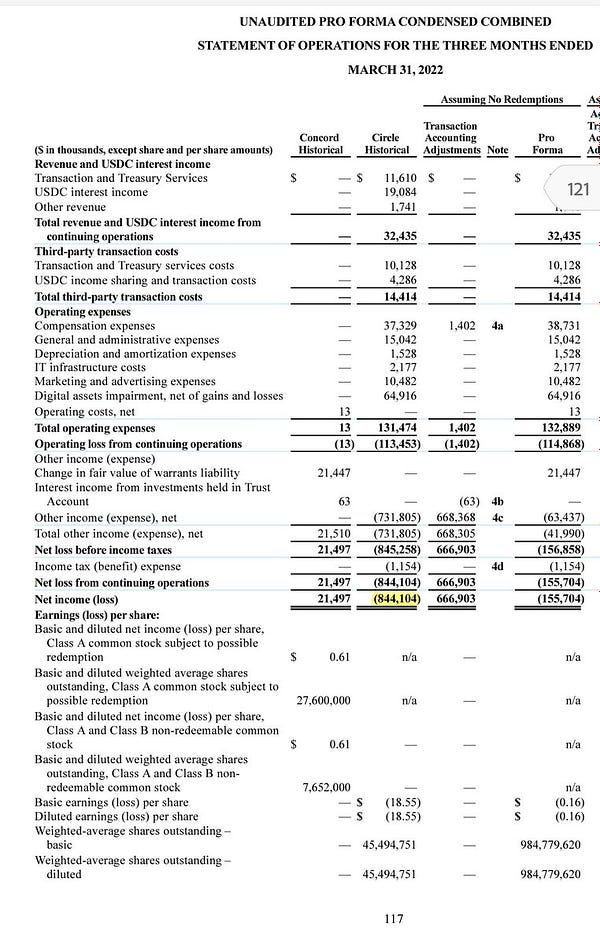

Almost two weeks ago, Crypto Owl wrote that something really suspicious is going on with stablecoin USDC.

Eh, turns out I was right. And I’m not happy about it.

Look at this:

Do you see what I see? Yep, STABLECOIN, which should be stable, lost more than $844 million!

So… what the hell, really?

Basically, what that means for us - is another possible collapse, like it was with Luna (still remember that one, right?).

I do not want to sound dramatic, but if people who hold USDC will decide to exchange it for dollars and take it back, well… they just won’t get them. And this is where the worst scenario could start to build up.

And the best thing is that these numbers are unaudited. It’s possible that if audited, numbers (losses) could be bigger. This is just amazing.

One way or another, I believe there will be updates. Trust me; I’ll bring you those.

SEC CATCHES BAD GUYS FOR PYRAMID SCHEME

It seems like SEC (the U.S. SECURITIES AND EXCHANGE COMMISSION) has a lot to do these days.

What happened?

This time SEC has charged 11 bad actors responsible for creating a crypto pyramid and Ponzi scheme and, it goes without saying, stealing money from investors. This Pyramid scheme has been hiding under the project called Forsage.

Forsage is (or was) a blockchain networking platform based on smart contracts and, according to its website, “#1 Smart Contract for <...> decentralized business.” However, now we know it wasn't that legit.

According to the SEC, Forsage created their Ponzi scheme very easily. The Ponzi scheme’s point was to find and attract new investors, so they could later pay for already existing investors with their funds. Usually, new investors are also being promised to generate high profits with little and insignificant risk.

… and what did Forsage’s Ponzi scheme look like?

Forsage would enable new investors to create crypto wallets and purchase Forsage’s so-called “slots” from smart contracts. Owning “slots” gave the right to receive earnings from people who recruited new investors and also to profit-share with the community of Forsage.

And the more people you bring into this pyramid scheme, the more rewards you get.

It turned out to be more than $300 million was stolen from numbers retail investors globally.

So, the SEC charged 11 people for this malicious activity: four bad actors were Forsage’s founders: Jane Doe, Mikhail Sergeev, Vladimir Okhotnikov, and Sergey Maslakov. Another seven individuals were promoters, some of them - from the USA.

It is so disappointing that various scams and Ponzi schemes are still living, and living not bad at all. At least - it’s great that SEC managed to find and catch those Forsage’s bad guys.

A WOMAN, A HITMAN, AND A BITCOIN

What do these things have in common? Ooh, much more than you might think.

In 2021, a woman from Mississippi named Jessica Sledge decided to kill her husband. It sounds a little dark, I know, but wait.

Jessica has also decided to achieve this goal by hiring a hitman. Where? Of course, in the dark web. Great.

There’s just one thing… that hitman that Jessica found was an FBI agent. The woman communicated with him between September - November 2021.

You now can probably guess how Sledge paid for the assassin while contacting him. Sure, with Bitcoin. So, Jessica’s order cost her a nice $10k in Bitcoin.

On November 1st, she met the “hitman” face-to-face and was arrested for the murder-for-hire planning. So, however, this grandiose plan hasn’t worked out for Jessica at all - starting with her husband, who remained very much alive and ending with her arrest.

The U.S. Department of Justice just yesterday sentenced Jessica Sledge to 10 years in prison, a $1000 fine, and three years under supervision after she finishes her decade behind bars.

You know, even though this topic is about serious stuff… Somehow it’s funny. As Michael Scott would say - sue me - but it’s a comic story for me. I mean, this woman is creative, isn’t she? And at the end of the day, she got what she deserved.

It just makes me wonder… what Jessica’s husband did to her.

Ok, all jokes aside - we should all focus on the Bitcoin part here. There is a serious problem when crypto is being used for illegal actions, and this story just proves it. For such situations, crypto regulations would be really helpful. I understand that one of the main essences of crypto is anonymity, but sometimes it leads to dangerous scenarios like this story. So, I think we should be more understanding when we’re discussing crypto regulations.

TOP-NOTCH TUESDAY FACTS

Binance delisted one of its tokens - AMP. Why? Because, as you know, SEC is currently investigating Coinbase, the largest crypto exchange, for inside trading with unlisted tokens. It seems like SEC has identified AMP token as a security, and it made Binance take it out. Does Binance afraid to have the same destiny as Coinbase? I guess no one eagers to be investigated;

Yesterday I wrote about CryptoPunks and Tiffany’s & Co collaboration. Today CryptoPunks NFT sales jumped 248%! Fascinating.

Today is the Shiba Inu Coin Birthday! It turns 2, so happy birthday, you sweet meme coin! 🎂 🎉

MORE CRYPTO NEWS AROUND THE WEB

BUBBLE TEA

💜 HOW DID YOU LIKE THIS NEWSLETTER? 💜

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your research and act responsibly with your profits.