Coo coo! As a Crypto Owl, I have some fantastic news for you and a very filling Monday. Shall we get on with it immediately?

On Today’s Menu:

🍔 DRIPPING CHICKEN BURGER: Bitcoin 200 weekly moving average approaching - what does that mean?

🍟 BAKED FRENCH FRIES: Coinbase shuts down the U.S the affiliate program

🥕 KIMCHI SALAD: TOP 5 CRYPTO NEWS

BITCOIN 200 WEEKLY MOVING AVERAGE APPROACHING - WHAT DOES THAT MEAN?

Bitcoin is approaching the 200 WMA (weekly moving average), which is currently $22708,74. As you may or may not know, it is a great technical analysis metric to follow to understand what’s happening in the market - even for newbies.

So if Bitcoin reaches this price, it would become the “support,” or officially called support level for Bitcoin. It would be a signal that the market is expected to go up.

But who’s responsible for Bitcoin going upwards?

The boost had a clear catalyst event: Ethereum developers, once again (but this time for real), announced a precise date of the network’s update (a.k.a. The Merge, or Ethereum 2.0).

As this is the second most popular blockchain network with the broadest applications in the market, Ethereum went up 30% in the last few days, and Bitcoin followed with a 10% increase.

Finally, a breath of fresh air in the avalanche through rocky roads…

But waaait a minute. What if Bitcoin doesn’t reach this 200WMA? Well… Then the 200WMA becomes “resistance” and would signal Bitcoin going even lower.

So, one must be careful in a bear market. The tingling tension of the weekly moving average could signal a bear market relief rally. To give a metaphor to this, it’s like giving it a good jump on a trampoline for the first time and waiting for the energy to stop swinging you up and down…

What’s a relief rally according to economists’ terms? → A breathing space from a broader market sell-off that results in temporarily higher prices.

Why do we think this could be a temporary relief?

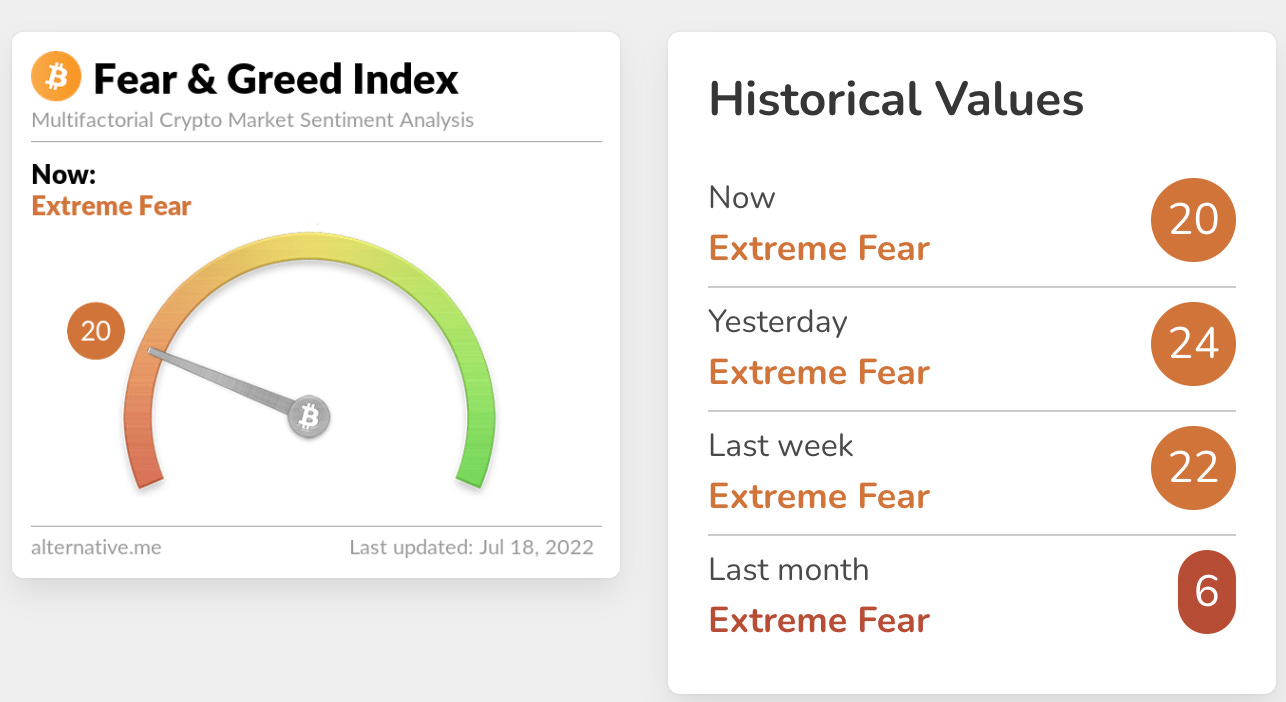

Just check the Fear and Greed index (we have a video about how this index is made up!). It seems like not so much has changed… The market is still in Extreme Fear, so it’s unlikely it can take off to 10,000 feet this week.

Moreover, Bitcoin miners are under pressure as it has become not so profitable to mine Bitcoin right now. Some fear that this period could lead to some miners capitulating. After all, they’re like fish 🐠🦈 in troubling waters: rising borrowing rates, skyrocketing energy expenses, narrower profit margins, and lawyers coming after crypto…

The EU 🇪🇺 could soon outlaw Proof-of-Work mining, which could roll another tsunami over Bitcoin and the whole crypto market.

If more miners move to more profitable and legal deeds, it could be difficult for everyone to remain standing on their feet!

And yet, we have to wait and sail the waters...

Yes, the sending of bitcoin from miners to exchanges has been climbing since June 7, 2022, but… This could once again become the “clean seas” mission for the market from those not interested in the long-term growth of the market. To let you know, Crypto Owl will be on the watch for any upcoming events!

COINBASE SHUTS DOWN THE US AFFILIATE PROGRAM

According to leaked and widely approved data, the official Coinbase e-mail read: “We regret to inform you that Coinbase will be temporarily shutting down its Affiliate Program in the United States with an effective date of Tuesday, July 19.” Such a bold move could have a long-term negative impact and a train of failed future deals with partners promoting Coinbase. Which in turn and altogether… This may reveal why Coinbase may not see any growth in this bear market.

But why else are experts worried? Well… It’s sad to say, but consumers withdrew almost $250 M worth of stablecoins from Coinbase amid liquidity fears on July 15. And some red flags have been getting in Coinbase’s way while trying to land safely down this crypto slalom.

First of all, on June 14, Coinbase CEO Brian Armstrong announced an 18% layoff of its staff, roughly 1,1000 employees. Then, Coinbase was reported to go down from 4th to 14th position among the largest crypto exchanges in the world in less than a year. Consumers whispered about the need to move personal crypto funds from the exchange’s custody and straight to private wallets. But Brian reassured them there was no need… Was that fair to say?

Well… Here’s Owl’s takeaway:

Breaking a wide range of affiliate deals is bad for long-term business. Many promoters could lose trust and reject future collaborations, even if Coinbase restarts its program in 2023 as promised.

Now, if other exchanges continue their affiliate programs and showcase iron resilience through difficult times… Why should anyone go back to Coinbase? It could very well be that crypto affiliates were counting a lot on the big boys of the market on their monthly incomes.

Unfortunately, that almost $250M sweep of funds from Coinbase also does not sound light… Could it be IT for Coinbase? We say… May the strongest survive!

MORE CRYPTO NEWS AROUND THE WEB

Coinbase got a license as a crypto asset service provider in Italy

CryptoPunks NFT Owner Sells for $7 Million Loss – But There’s A Catch

Pro Skater Tony Hawk Delves Into the Metaverse to Build Largest Skatepark

🍺 YOUR FAVORITE CRAFT BEER

💜Did you like this newsletter ?💜

With your feedback, we can improve it. Click on a link to vote:

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your own research and act responsibly with your profits.