Coo! It's a Crypto Owl. Friday is here, so let’s celebrate it together (or, stay sad together) with top crypto news to close this week.

On Today’s Menu:

🕛 Estimated read time: 3 minutes & 55 seconds

🥘 STEAMY RATATOUILLE: There’s more to the Celsius story (behind the scenes)

🥐 BUTTERY CROISSANT: Top 6 Crypto News of the day

THERE’S MORE TO THE CELSIUS STORY (BEHIND THE SCENES)

In previous newsletters I’ve talked about Celsius, and how its failure had an impact on the crypto market. To be precise - Bitcoin and Ether.

Very short recap: Celsius Network had massive debts, and has been sending huge amounts of wrapped Bitcoin and Ether from a decentralized lending protocol called AAVE, to another exchange platform called FTX. Celsius had an enormous amount of staked Ether that lost its peg (1 stEther = 1 Ether) and people started to freak out and take out their funds from the Network causing Celsius to suffer huge losses.

Now, what actually happened in the background?

Let’s start from the very beginning (as we know).

Remember when the Terra Luna crash happened? It was the end of the first week of May. Yep, that was the first domino to go and now we can see the impact it had on the rest of the crypto market.

At that time, major whales with skin in the game (who held UST) had a consensus to stay strong and not to sell it (Celsius was one of them). All of this because Terra Luna developers had “a plan” to save the UST peg: Do Kwon, CEO and Co-founder of Terra Luna, was very inspiring as he tweeted to “hang tight”.

Sadly, we all know how that turned out.

Anyway, this is important because Celsius was one of those companies (next to the Jump Capital, Jane St., etc.) that decided to sell everything to save themselves and protect their users, despite Do Kwon’s specific request to stay united and weather it out together.

In contrast, Alameda (FTX), another crypto trading platform, sold nothing. Not a single UST. What determination! Much wow!

As time went on, pretty much nothing changed. But it was clear that Celsius managed to break free first, and even though it lost money, it faced the lowest losses compared to the others: Alameda (FTX), 3 Arrows Capital, Galaxy Digital and Jump Capital lost $100’s millions each. Good call, Celsius! Or was it?

Now, let's jump back to Alameda (FTX), which seemed so neutral during these weeks’ turbulence. Apparently, after Terra crashed there was some “rumors” of bad blood to get back at Celsius for acting out ahead of everyone else.

Soon very interesting news has started to unravel across the depths of the internet and now Alameda (FTX) is gaining some spotlight, that it is very possible they were the ones behind the Celsius downfall all along. Let’s trace it back:

Starting back in 2021 or even earlier, Alameda (FTX) started to invest in crypto brokerage companies like Voyager Digital, and soon articles about possible manipulations started to appear on the internet. Speculations started to appear that Alameda (FTX) organized FUD (fear, uncertainty and doubt propaganda tactic) campaigns to trigger panic selling..

Doesn’t it seem suspicious? Cause that’s exactly what happened to Celsius.

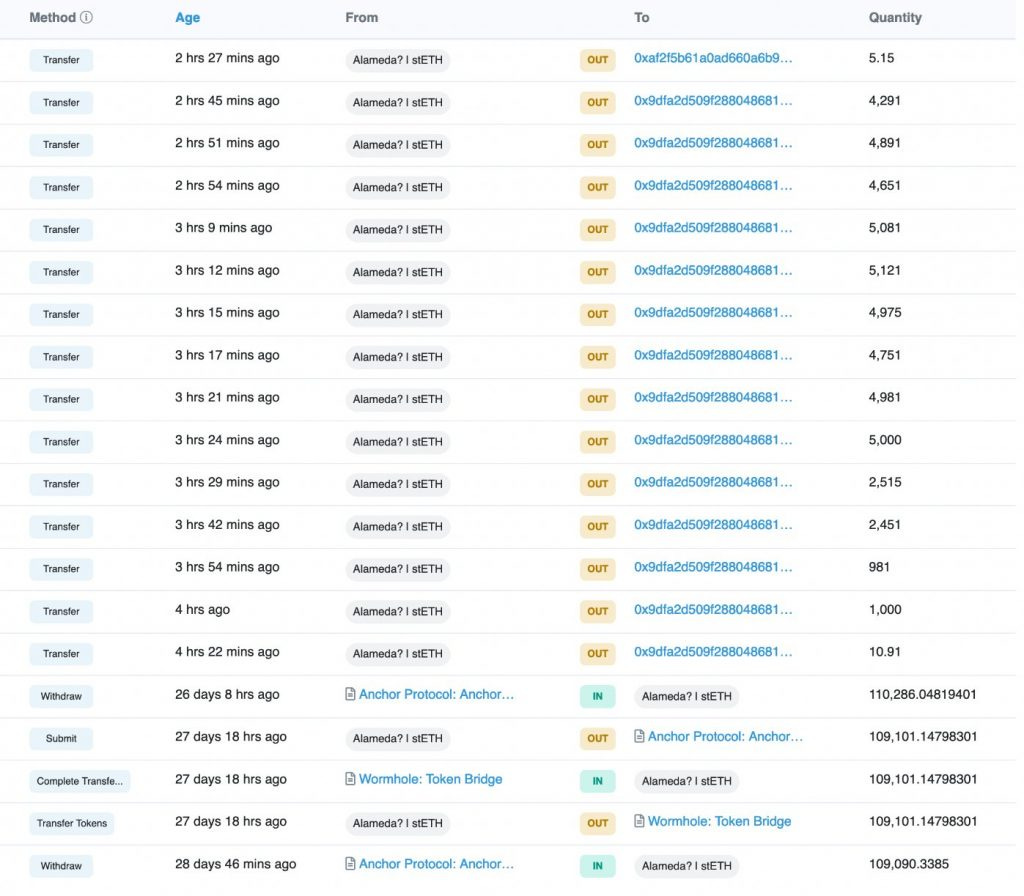

Everything started going down the hill, as “someone” started dumping massive amounts of staked Ether… And according to Onchain data, it shows that “that mysterious someone” was Alameda swapping around 50k stETH to ETH. See yourself.

It seems like it was a well-calculated trigger to liquidate Celsius… So, can we blame Alameda (FTX)? Or was it someone else behind this? I’ll leave you to think about it.

So much drama. Much better than 99% of what I’ve watched on Netflix this year!

TOP 6 CRYPTO NEWS OF THE DAY

CIGARETTE

GLASS OF CABERNET SAUVIGNON

🎉 Special Friday treat - don’t miss it! 🎉

💜Did you like this article?💜

With your feedback, we can improve the newsletter. Click on a link to vote:

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your own research and act responsibly with your profits.