NOT A ONE CALM DAY IN THE CRYPTO WORLD

Binance US added ETH for staking right before the Merge. Bitcoin is going to be huge. Flash-loans unleashed.

Coo! Good morning dear readers. It’s me, Crypto Owl. Today is International Literacy Day, so I’ll try to be as thorough as I’ve ever been and leave no grammar mistakes.

Shall we start with the news?

On Today’s Menu:

🥐 CROISSANT WITH CREME BRULE FILLING: From Now On, You Can Stake ETH On Binance

🥑 AVOCADO TOAST: Bitcoin To Overcome Everyone (?)

🫐 OATMEAL WITH BERRIES: Flash-Loan Exploits Unleashed

🍎 SLICED APPLES WITH PEANUT BUTTER: More Crypto News Around The Web

FROM NOW ON, YOU CAN STAKE ETH ON BINANCE US

Right before the Merge? Yes, please.

Maybe Binance US waited for this and became the latest major crypto exchange that allows staking Ethereum coins just at the perfect time.

And not just casually stake but to earn the highest rewards with interest rates of 6% APY (annual percentage yield).

The best you can get in other more prominent cryptocurrency exchange platforms is 3,5%-5% max.

No surprise that Binance is proud. Binance US CEO Brian Shroder said, “As the Ethereum network continues to transition towards The Merge, we are thrilled to now offer ETH staking with some of the highest APY rewards in the industry”.

Usually, to stake ETH for one person takes around 32 ETH to put into a blockchain network. And, my friend, that’s A LOT OF MONEY.

Binance US, on the other hand, requires 0,001 ETH to start your staking journey, and it makes around $1,50 if we look at ETH prices nowadays.

But maybe it’s only a sugar coat? Binance, just like other major crypto exchange platforms, is a third party here. So, they basically control the whole ETH staking process. Could it lead to any problems? Considering what happened to the Tornado Cash… well, it just raises safety questions. Maybe in a time, we’ll hear some comments on this from Binance or other cryptocurrency exchange platforms.

Moreover, it is essential to know that if you stake ETH on Binance, you cannot “unstake” it or get rewards until the Merge is over (and hopefully, it will go successfully). The same will happen during the incoming Shanghai Upgrade - for now, it is expected in early 2023 - on the network. So, keep that in mind.

BITCOIN TO OVERCOME EVERYONE (?)

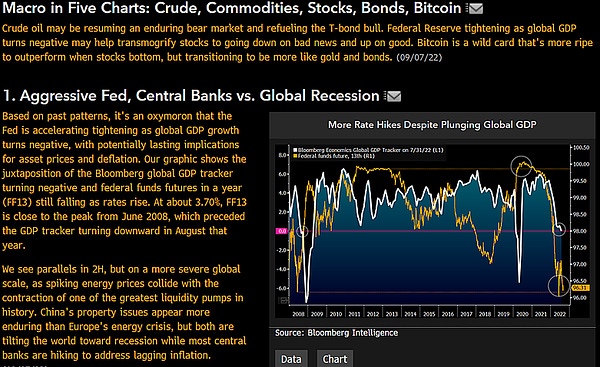

At least, that’s the opinion of analyst and commodity strategist Mike McGlone. He says that Bitcoin is going to outperform traditional stocks and markets.

McGlone claims, “Bitcoin is a wild card that’s more ripe to outperform when stocks bottom, but transitioning to be more like gold and bonds.”

Everybody knows that The Federal Reserve’s tightening and hawkish moves on inflation control strongly affect markets and cryptocurrencies. And some people believe this correlation becomes stronger over time, which is not a good sign, especially not a bullish sign.

Well, opinions defer, and that’s fine. But, if you agree with Mike McGlone, then you can check this page and find the smartest ways to spend your crypto.

FLASH-LOAN EXPLOITS UNLEASHED

Two days in a row - two flash-loan exploits.

A flash loan is a specific loan: it allows you to borrow massive amounts of money without any upfront collateral deposit. Sounds too good to be true? Often, it is.

Some DeFi protocols offer this service: you can take a lot of money without a deposit, but you have to return them in a set time in one transaction. However, that is the part where bad actors hunt their victims. And, apparently, they are good at it.

I’ll better give you very fresh examples:

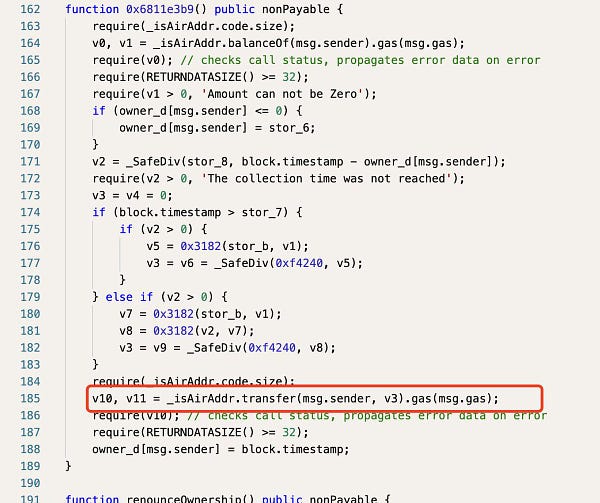

Yesterday Avalanche-based DeFi protocol Nereus Finance suffered from a flash loan that led to $371k worth of UCDC being stolen. According to Neurus Finance released post-mortem, “an exploiter was able to deploy a custom smart contract, and that leveraged a $51M flash loan to manipulate the AVAX/USDC Trader Joe LP pool price for a single block resulting in the ability for the exploiter to mint 998,000NXUSD against ~$508k worth of collateral”. The developers’ mistake, that exploiter used to stole money, was a missed step in price calculation on recently launched new collateral type, “supporting AVAX/USDC Trader Joe LP tokens.”

Today DeFi protocol News Free DAO faced not one but several flash loan attacks, repeatedly created by the attacker. Total losses are worth $1.25 million. And protocol’s native token, NFD, slipped in price by 99%.

So, you better avoid flash loans - easy and big money is very tempting yet dangerous.

MORE CRYPTO NEWS AROUND THE WEB

GameStop Partners With FTX US to Bring Gaming and Crypto Communities Together

Thailand’s Financial Regulator Filed a Complaint Against Zipmex

💜 HOW DID YOU LIKE THIS NEWSLETTER? 💜

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your research and act responsibly with your profits.