OH MAN, BITCOIN, NOT AGAIN

The largest cryptocurrency closes on the lowest since 2020. Bellatrix upgrade: successful, yet not really. Stressful time for DeFi protocols. A guy who won a Bitcoin lottery.

Coo everyone! It’s me, Crypto Owl. This Wednesday is going to be delicious because today is National Salami Day! Weird enough, I do like salami, even though I’m Owl.

Anyway… let’s take a look at today’s news!

On Today’s Menu:

🍔 VEGETARIAN BURGER: There’s A Lot Of Going On With Bitcoin

🍕 PIZZA WITH SPICY SALAMI: How Did The Bellatrix Go?

🌭 HOT DOG: Stressful Days For DeFi Platforms

🍟 FRENCH FRIES: More Crypto News Around The Web

BITCOIN IN THE CENTER OF THE ACTION

Yesterday Bitcoin ended its day on not the best note.

Bitcoin’s Daily candle closed at $18,790, which is THE LOWEST close-up since 2020.

On top of that, overall largest cryptocurrency’s market value dropped below $1 trillion.

Were there any reasons for that?

Apparently, there were:

The Dow Jones Industrial Average fell and closed more than 170 points lower;

S&P 500 dropped 0,41%;

Nasdaq also slipped by 0,74%;

What I want to say here is that major players in the market closed out in the third negative week in a row. And we already know that this market strongly correlates with the crypto market. It must have had an effect on Bitcoin yesterday.

Oh, and don’t forget that everyone is scared of the Federal Reserve’s actions of continuing to hike interest rates. Not to mention Russia’s some kind of revenge-based decision to shut down the Nord Stream 1 pipeline last week; gas prices rose in Europe, affecting markets negatively. So, everything is related.

Naturally, the community reacted with mixed emotions - some are excited because Bitcoin is even more, cheaper now; some, on the other hand, are fearful of what’s going to happen and if even worse times are coming.

American stockbroker Peter Schiff said that Bitcoin holders better “abandon ship before the bottom drops out.” Ay ay, Captain! (no one cares)

HOW DID THE BELLATRIX GO?

So… it happened! However, not super smooth.

The community is unsure about preparing for the Merge now.

So, where were the bumps?

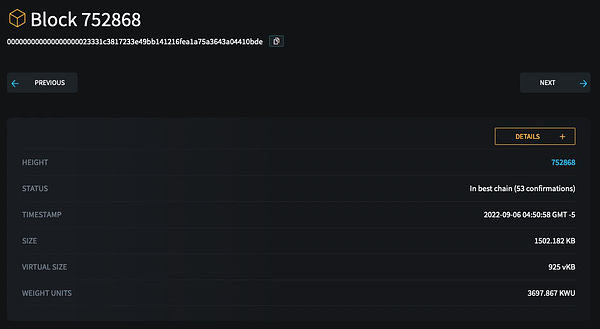

Well, maybe one bump - block rate was missed. The block rate is the frequency when a network fails to verify a block of ready-to-be-validated transactions.

Historically, block rates usually reach around 0,5% (meaning 0,5% of all blocks slated for validation on Ethereum Network fail to be validated); this time, it hit more than 9%. So, the difference is massive.

Why did that happen?

This hiccup possibly did happen yesterday due to a lack of nodes’ (network users) preparation. Before the Bellatrix upgrade, there were a number of reminders (even Vitalik tweeted one) about updating merge-ready software. Nodes that haven’t done it must face various failures, for example, not to being able to send Ether after an updated version of the blockchain.

Ethereum core developer Marius Van Der Widjen said, “The nodes who have not yet updated will get inactivity leaked”. Who wants that? I guess nobody.

Despite that, everything ended successfully. Widjen added, “I anticipated even more people not updating <...> I’m very surprised how great it went.”

Hence, there is only one step left since Ethereum moved entirely to Proof-of-Stake Consensus. And it’s coming next week.

Hopefully, it won’t go like this:

STRESSFUL DAYS FOR DEFI PLATFORMS

Continuing about the Merge on its way…

People like crazy are taking ETH loans from DeFi platforms, causing harm.

Why would someone do that, you ask?

It’s easy - speculators want more money; they believe taking out ETH loans will maximize their profits after the Merge. You see, ETH hodlers that are now on the proof-of-work consensus chain, after the updated Ethereum 2.0 version, might get equivalent amounts of new tokens to their ETH holdings (ETH balance will be duplicated after the Proof-of-work chain is forked).

So, some smartypants decided to make more significant profits from that.

However, this behavior messed up things for DeFi lender protocols such as Aave or Compound Finance. Basically, such massive loans created unprofitable positions and pressure on liquidity supply.

What did lenders do to stop this?

Aave surged ETH loans until the Merge ends;

Compound Finance has set the borrowing cap at 100,000 ETH until the Merge ends.

Hopefully, it will stop all the degens.

WEDNESDAY FACT

Some very lucky person just won the lottery of a lifetime.

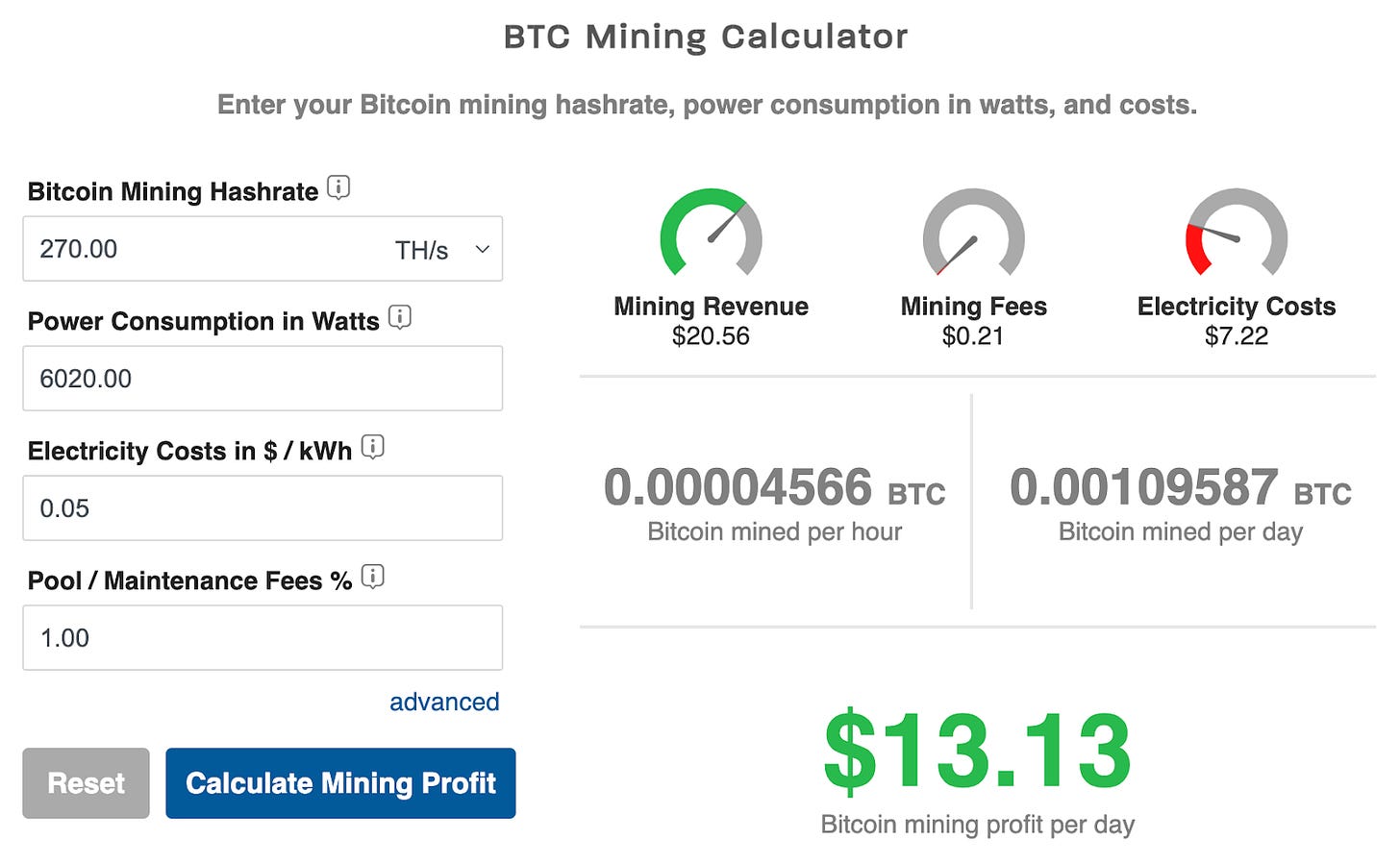

I did some calculations. With a hash rate of 270TH, this person could make around $13 daily. According to Bitcoin mined per day data, this person would mine 1 BTC in almost 3 years.

And now… well, what can I say? It’s a jackpot!

MORE CRYPTO NEWS AROUND THE WEB

South Korean Financial Regulator Aims to Roll Out Security Token Guidelines

Celsius Co-Founder Daniel Leon Claims That His Equity Stake Is “Worthless”

HIVE Blockchain Is Searching for Ethereum Mining Alternatives

Brazilian CVM Prohibits Bybit to Provide Securities Intermediation Services

💜 HOW DID YOU LIKE THIS NEWSLETTER? 💜

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your research and act responsibly with your profits.