QUIET BEFORE THE STORM?

The NFT market may soon pop like a bubble. Mysterious actors just transferred colossal amounts of USDT into Binance wallets. Mark Zuckerberg does his thing again.

The Crypto world has no weekends, so the hive buzzes at full intensity despite it already being a Friday. I, The Crypto Owl, dived straight into it, and here’s what I’ve got for you today.

🌶 CAROLINA REAPER TO START YOUR DAY: Crypto is crashing (again)

🌯 BLACK BEAN WRAP: Mysterious wallet transfers over $2B worth of USDT

🥗 CAPRESE SALAD: MercadoLibre create their cryptocurrency

🍹 PEACH ICED TEA: Mark Zuckerberg takes an L

🥑 AVOCADO TOAST: NFT market crash may be coming

🍮 CRÈME BRÛLÉE: Top crypto news

THINGS ARE NOT LOOKING GOOD

Okay, so once again, we’re seeing more red than green on price charts. Here’s a quick presentation of what’s happened during the last 24 hours:

Bitcoin down 8.41% (price now $21,549.75)

ETH down 8.79% ($1,702.60)

BNB down 8.33% ($283.54)

So these are some numbers that mark either the beginning of something terrible… Or the continuation of the bad that’s been around us for quite a while already. Either way, things are DOWN. ⬇️

MYSTERIOUS WALLET TRANSFERS OVER 2B USDT TO BINANCE WALLETS

Eyebrows have been raised. What is going on? After all, no one casually transfers over $2B worth of crypto assets. They must have something in mind before taking such actions.

It’s not surprising why the community got worried. What if this entire amount is about to be liquidated in one sudden move? Or maybe some massive investments are about to be made? Either way, when it comes to amounts like this, every bold move could start a ripple effect that could cause a domino effect in even seemingly-unrelated coins or sectors.

But that’s not all regarding Tether.

Tether has shown some effort to make its stablecoin more transparent. It’s been announced that Tether has appointed BDO Italia, an accounting firm, to calm down the doubtful voices who suspect Tether of not being open enough about the actual state of the situation that their reserves are in. BDO Italia will publish monthly reports about Tether’s $67B reserves.

Steps like this signal a new chapter in the stablecoin world since new pressures from financial regulators worldwide have been applied to stablecoins since the Terra Luna debacle that unfolded just months ago.

MERCADOLIBRE CREATES THEIR CRYPTOCURRENCY

MercadoLibre, a South American e-commerce giant, has announced its plans to create its new cryptocurrency that will go under the name of MercadoCoin.

This comes as a part of MercadoLibre’s loyalty program and will be used as a reward system for their clients. After earning MercadoCoin, clients can use it for new purchases or trade it on MercadoPago - the company’s financial services unit.

In the beginning, MercadoCoin will be valued at $0.10 a coin. Later on, the price may change when it enters the market. And it may rise since its user base is a strong card.

Since yesterday, It has already been available for 500,000 clients in Brazil and is planned to reach the entire MercadoLibre’s Brazilian clientele in the following weeks. The size of this user base? 80 million unique people. Further expansion is in their plans, even though it hasn’t been not officially announced yet.

In any case, the conclusion here is simple. There are new players in town.

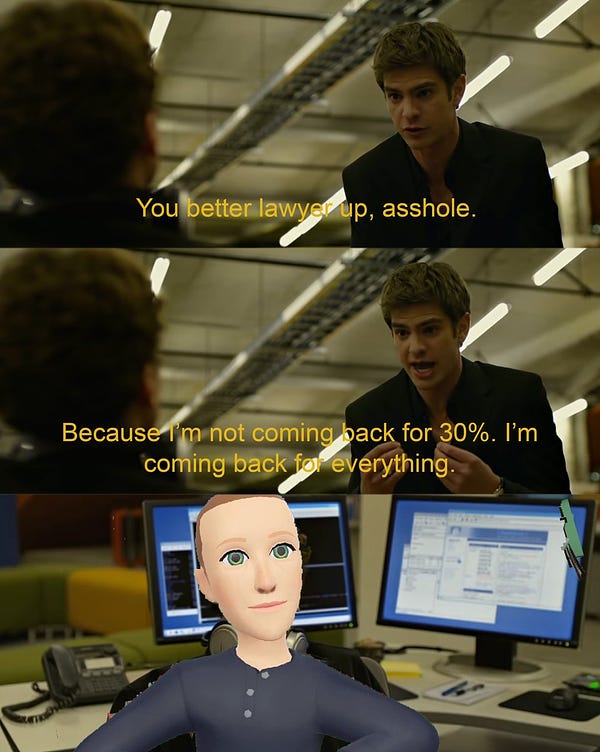

MARK ZUCKERBERG LAMPOONED FOR META’S METAVERSE

They said they’re investing $10 billion into creating THE Metaverse. And now Mark has just proudly posted this absolute-hell-of-an-abomination that should represent something the world is supposed to wait for in anticipation.

As Zuck’s post says, they’re celebrating the release of Horizon Worlds in France and Spain. It’s a VR game that shows that we are far away from Metaverses, not looking terrible. Imagine being a Meta investor and observing Mark proudly unveiling this product worth billions while simultaneously reading how the world reacts to it. This screenshot has been called ‘eye-gougingly ugly’, and some fresh memes have been baked.

NFT MARKET MAY BE IN DEEP TROUBLE

Not surprisingly, the crypto market crash made an impact on NFT prices as well. It can be easily illustrated by looking at the floor price of certain NFTs (the lowest amount a buyer would have to pay to acquire one of those pricey jpegs).

For example, The Bored Ape Yacht Club has dropped from over 153 ETH in April to around 69 ETH today.

Things get more enjoyable when you realize that there have been people using NFTs as collateral for loans so they could buy real estate.

Some crypto lenders accept people’s NFTs as collateral for a loan. The only catch here is that if the value of the said NFT drops… a liquidation mechanism gets activated.

And the NFTs go on to be sold at an auction. And so it happens that NFTs’ prices have plummeted. This means many were liquidated by these NFT-lender companies or are about to be liquidated soon.

For example, let’s look at BenDAO, a DeFi lending platform. They provide the exact NFT loan service. And if you look at the list of NFTs already used for taking out a loan…

You see that quite a number of those are experiencing a rapid decline in their value and are approaching the point of being liquidated… This might trigger a real NFT market crash. And judging from what we’re already seeing… Things don’t look good.

MORE CRYPTO NEWS AROUND THE WEB

Wife of arrested Tornado Cash dev forbidden to speak with him — Rally organized

Hodlnaut cuts 80% of staff, applies for Singapore judicial management

Crypto market bloodbath leads to over $500M in liquidations in 24 hours

AFL’s first limited-edition NFT drop sells out in under 12 hours

💜 HOW DID YOU LIKE THIS NEWSLETTER? 💜

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your research and act responsibly with your profits.