SNOWSTORMS IN THE CRYPTO MARKET ARE GOING STRONG

Shortening Bitcoin is a good thing (?), bad days for exchanges continue, and crypto news from Brazil

Coo! It’s Crypto Owl. How’s your Tuesday? I hope it’s really great, and I’ll make it even more awesome with some fresh crypto news. Without further ado, let’s fly into it.

On Today’s Menu:

⏳ Estimated reading time: 3 minutes

🍝 YUMMY SPAGHETTI: Bitcoin shortening made up 80% of weekly inflows.

DESSERT BY YOUR CHOICE

🍮 LAVA CAKE: Bitcoin and Ether prices go up after the 4th of July.

🍩 DOUGHNUT: More bad news for Crypto exchanges

🍨 ICE-CREAM: Brazil creates Crypto Investigation Unit.

BITCOIN SHORTENING BROUGHT 80% WEEKLY INFLOWS

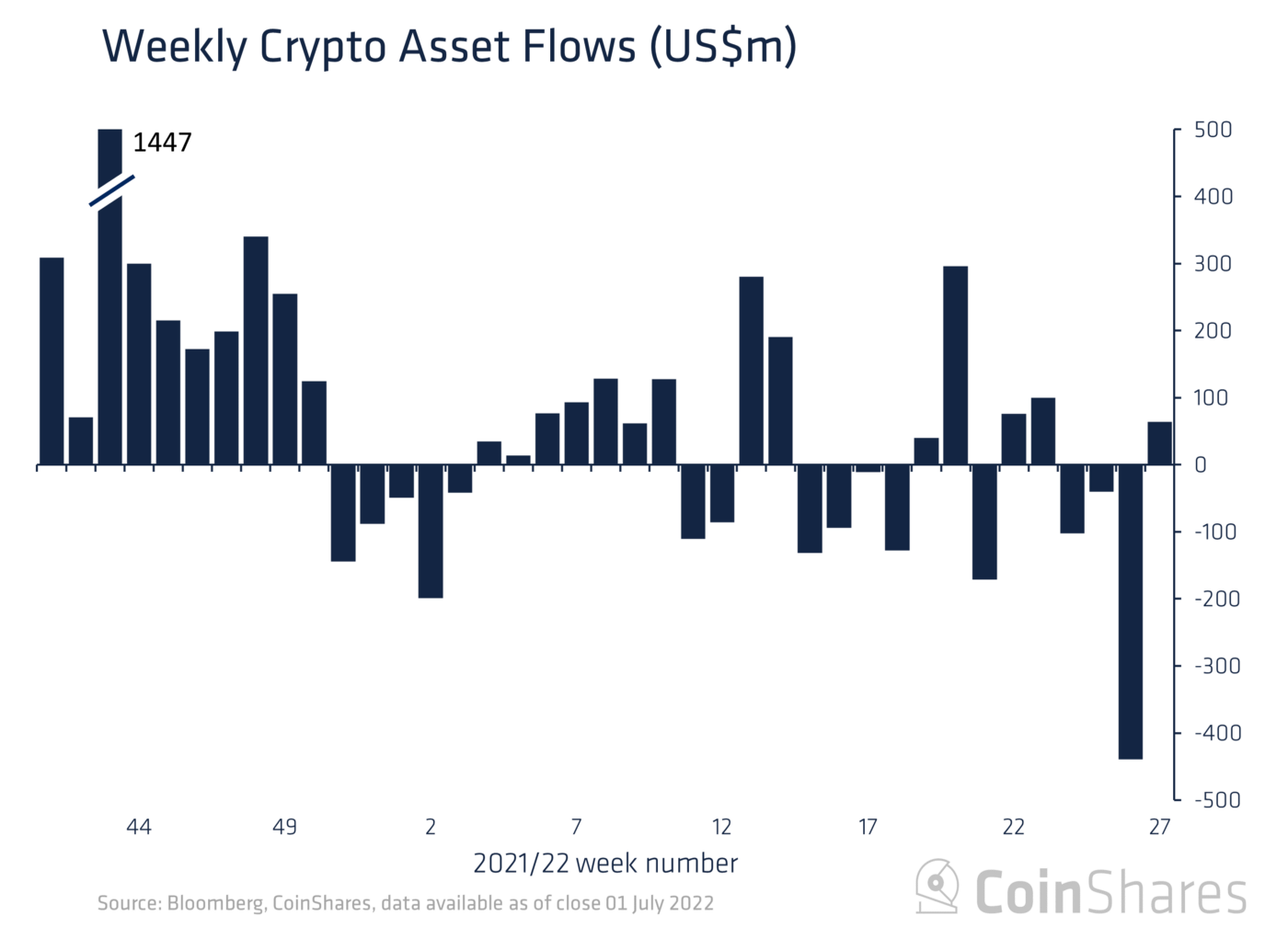

According to the “Digital Asset Fund Flows” report, from June 27th to July 1st, there was $64 million inflows of digital asset products. And 80% of that inflows (which makes ~$51.4 million) came from shortening BTC funds.

But those inflows came not only from the US (well, yes, it took the biggest part of it). Small inflows appeared in long-term investment products in regions like Switzerland, Canada, Brazil, and Germany (in total, it made up to $20 million).

Not only did Bitcoin see its inflows over the week. Ethereum, after 11 weeks of outflows (finally!) saw a few inflows adding up to $5 million.

Solana, Cardano, and Polkadot also saw inflows totalling $1 million, $0.6 million, and $0.7 million, respectively.

What does it mean?

It shows that investors are adding to long positions with current prices. However, it hides the fact that a significant majority of investors were into short-bitcoin investment products. The rush in short Bitcoin fund inflows also comes after the prior week, when there was $423 million worth of outflows for digital asset products.

Talking about altcoins, those inflows that I’ve just talked about suggests that investors might be ready to diversify their investments again.

BTC AND ETH PRICES GO UP AFTER THE 4TH OF JULY

Good news! Maybe it’s fireworks, maybe it’s just a coincidence. Some people are talking that “crypto tourists” is out of the market. Only HODLers stayed. And that might helped prices to stabilize a little bit more. Well, one way or another, Bitcoin and Ether prices actually went up.

Just in 24 hours, Bitcoin went up by 5%, reaching slightly more than $20k. An even better situation is for Ether - it has gained 9% and now its price reaches around $1,150. So that’s really nice to see.

Other cryptos also noticed to gain quite a nice percentage up. For example: Solana went up 7.8%, Avalanche - 5.26%, Polygon - even 14% up!

Of course, it’s not enough to compensate for the losses from this Crypto Winter (which is not over yet). But hey, let’s focus on the bright side, ok?

MORE BAD NEWS FOR CRYPTO EXCHANGES

Yesterday I talked about rumors in a community that the exchange platform KuCoin is insolvent and halting withdrawals. Even though KuCoin CEO Johny Lyu declined them, it appears that the community didn’t buy them.

Dominos' effect is strong. Today KuCoin’s native token, also named KuCoin (KCS) tanked around 17%. Now its price is slightly lower than $9. So, things are not the best for KuCoin… But I don’t believe that KuCoin, the 5th largest cryptocurrency exchange in the world, can fail.

Speaking of failing, there is another exchange that actually failed. Singapore-based platform - Vauld, due to “financial challenges” and “volatile market conditions”, has paused all withdrawals, trading, and deposits from their systems. Vauld is the latest victim of this whole fallen cryptocurrency exchanges landslide. Sad.

BRAZIL CREATES CRYPTO INVESTIGATION UNIT

If the question “...created a what?” just came into your mind, well… this “Unit” creation could sound like a strange idea at first, but actually, it’s quite logical. Let me explain.

Brazil is one of the countries that faced numerous crypto-related scams. And, in order to create a safer environment using cryptocurrency, Brazil’s public prosecution office of the Federal District decided to establish a Crypto-Dedicated Investigation Unit. Apparently, comparing traditional crime cases, and criminal cases related to cryptocurrencies - they are more difficult, so the Unit should be very helpful.

The newly formed Unit is going to:

Focus on helping prosecutors in cryptocurrency-related case investigations;

Educate consumers about safe crypto use.

The coordinator of the project Frederico Meinberg has said that “the best training for an agent dealing with digital assets is to interact with the market. Without practice, we can offer the best tools that, in the end, the agent will not know what to do with”.

I hope this project will find success. There are not many details of how is it going to work.

MEME OF THE DAY

COLD DRINK

💜Did you like this newsletter ?💜

With your feedback, we can improve it. Click on a link to vote:

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your own research and act responsibly with your profits.