TENSION RISES.

As the world observes the unfolding Tornado Cash drama, the ecosystem continues buzzing.

It is I, the Crypto Owl, and as the world turns, so do the crypto news cycles. Let’s get to it straight away!

If that’s the case - tell your friends about this Crypto Owl Newsletter! 🦉💜

On Today’s Menu:

🍝 CREAMY MUSHROOM PASTA: Last month’s CPI released

🍲 GNOCCHI: Tether praises Ethereum’s transition to PoS

🍹 LEMONADE: The number of Bitcoin ATMs worldwide approaches 40,000

🍤 SHRIMP SALAD: Top 5 crypto news

🍰 SOME GLUCOSE: We’re launching a new video format! Watch the promised Tornado Cash crash in-depth explanation!

INFLATION COOLS DOWN

The Bureau of Labor Statistics has just released the latest Consumer Price Index (CPI) update. CPI measures the average change over time in how many urban consumers pay for goods and services. And judging from the latest data, it looks like things are stabilizing. At least for now! So what does the CPI tell us?

Last month’s CPI was 8.5%. This number appeared to be lower than many expected. And it is lower than it was in June when the year-over-year increase was 9.1% - a 40-year high.

The Core CPI - indicator, which is calculated by excluding such volatile goods and services as food and energy, remains stable - 5.9%.

The gasoline index fell to 7.7%. Such figures mark a continuous downward trend in gasoline prices which is already lasting for more than 50 consecutive days. Well, no one’s mad about gasoline prices not increasing for once. But this doesn’t mean that the inflation is slowing down, and what consumers save at the gasoline station, they spend while grocery shopping.

Food prices continue to increase, as the Food Index shows a 1.1% increase over the last month.

As a response to a rather optimistic CPI reading, U.S. stock futures rose (S&P 500 futures gained 1.7%, while Nasdaq 100 futures jumped 2.4%)

Inflation may slow down, but it’s not enough to trigger a crypto bull run.

Despite that, the crypto market responded positively - only minutes after the report was released, Bitcoin jumped 2% and Ethereum 7%.

Even though CPI stands at 8.5%, it remains above Fed’s target, which is 2%. There remains quite a long way to go. It’s important to follow these monthly inflation readings because they’re directly related to what the Fed will do next. And there’s a strong connection between the value of the dollar and the value of Bitcoin. With the Fed increasing interest rates and embarking on an aggressive tightening cycle (the most aggressive one in over two decades, in fact) and seeing the dollar's index rally by 11%, the crypto community observed Bitcoin’s value dropping by 50%. Everything’s connected, and CPI is a clear indicator of what is going on and what we could expect next.

TETHER EMBRACES ETHEREUM’S PROOF-OF-STAKE TRANSITION

“Ethereum is nearing one of the most significant moments in blockchain history as it prepares to make a move from POW to POS.” These are the words that the issuer of the world’s largest stablecoin, USDC, has used to announce its support for the upcoming Ethereum transition. This is big news, and it signals Tether’s attention to the long-term health effects on the entire Defi ecosystem that uses Tether’s tokens.

Here’s what Tether said in their official statement:

”Tether believes that to avoid any disruption to the community, especially when using our tokens in DeFi projects and platforms, the transition to POS mustn’t be weaponized to cause confusion and harm within the ecosystem.” Sounds reassuring.

But… Why is this so important?

The long-awaited event, the merge, is planned to take place on September 19th. Essentially, what’s going to happen is that Ethereum is about to upgrade its protocol from proof of work to proof of stake. Such a colossal transformation is a source of anxiety for many because you can never be too sure if everything will go according to plan. With Tether on their side, the Ethereum community can feel safer for several reasons.

First of all, USDT is the most used stablecoin on the Ethereum blockchain, and it’s “trading at 10 times the volume of their closest competitor”, as Tether humbly states in their official announcement. Such an official embracement sends a positive signal toward the Ethereum community, making everyone feel more secure knowing that giants like Tether have Ethereum’s back. This means that the chances of something unexpected and potentially problematic occur immediately after the transition get significantly lower.

And there’s even more!

Tether is not the only stablecoin issuer publicly expressing its support for the anticipated Ethereum upgrade. Right before Tether, Circle - the issuer of USDC - also announced their support for the upcoming event. This represents the fact that essential players of the DeFi system see the transition to proof of stake as the desired direction of the future of the blockchain and DeFi ecosystems in general.

Not everyone’s happy.

You see, a transition from PoW to PoS will reduce Ethereum’s environmental impact dramatically - the blockchain will use 99% less electricity than it does today. That’s good for the planet. But that’s bad for… the miners, whose function will be rendered obsolete. All the mining rigs that they’ve set up and their ability to earn rewards after validated transactions will become a thing of the past. And all those mining rigs did cost quite a few bucks. So naturally, they’ve collectively expressed their intention to attempt a hard fork before the merge takes place. This means that they could copy and paste the code on which Ethereum currently runs and kick off a new Ethereum fork token - ETHW. This ‘W’ here stands for ‘Work’, as in Proof of Work.

But with stablecoin giants embracing the transition to PoS, this event becomes unlikely. And the reason is very simple. Why would most crypto traders choose ETHW, where they could trade USDT and USDC neither? They wouldn’t.

But there exists yet another way that miners could choose. They could collectively throw their gear and their funds to Ethereum Classic. This cryptocurrency was created in 2016 after a hack took place on the Ethereum blockchain, and the community split into two opposing sides, disagreeing whether the users who were affected during the hack should be compensated or not.

There are several potential scenarios. But with huge players embracing the transition to PoS, they all become less and less unlikely. Well, time will tell, and pretty damn soon.

NUMBER OF BITCOIN ATMs GROWS

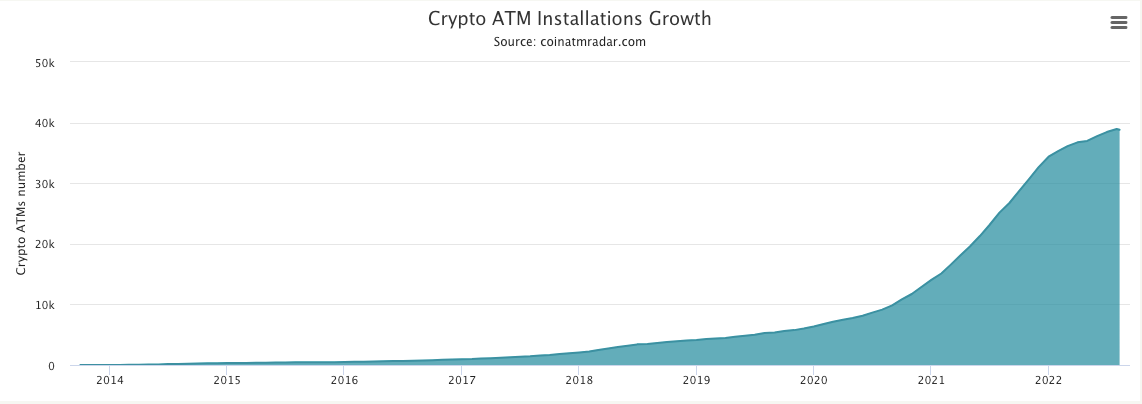

Yeah, we saw prices of pretty much everything fall down during the last months. Yet there was something rather specific - the amount of physical Bitcoin ATMs - has increased. And the total number of currently-existing Bitcoin ATMs approaches 40,000. Despite the number looking juicy, this also symbolizes the fact that the world is slowly, yet steadily, embracing cryptocurrencies. And this is happening in the bear market!

As of today, it’s reported that 614 operators have installed 39,008 crypto ATMs across 77 countries. As you can see in the chart below, the sudden upward trend has slowed down in recent months, but it’s already showing signs of recovery.

Despite the recent slowing down, the number is nevertheless increasing. And if you put it into perspective, you can tell what a journey it has already been. For comparison, at the start of 2017, there were only 969 crypto ATMs globally. So the situation has changed. And where are most of these machines located? You guessed it, North America is where 95% or 37,074 of the world’s crypto ATMs can be found.

Well, even though we’re living in times of uncertainty (well, these times never end for everything crypto-related), one thing is guaranteed. We’re about to read the news about the total number of Bitcoin ATMs worldwide reaching 40,000.

MORE CRYPTO NEWS AROUND THE WEB

Coinbase Posts $1.1B Loss In Q2 On ‘Fast And Furious’ Crypto Downturn

German Crypto Bank Nuri With 500K Users Files For InsolvencyMore Than $600K Vanishes From DeFi Project Blur Finance As Developers Disappear

Iran Makes $10M Import With Crypto, Plans ‘Widespread’ Use By The End Of September

🍰 SOME GLUCOSE

Crypto Owl knows what a promise is! We promised, and today we deliver.

Check out this video about how The Tornado Cash Crash is still wreaking havoc in the crypto land. Watch it to get an in-depth understanding of what it could mean for the entire DeFi ecosystem.

This video marks a new beginning for videos of this format. Be sure to check it out, and if you’ll like it… you know what we’re about to say next.

Like, share, and subscribe! That’s the only way for our community to continue growing.

💜 HOW DID YOU LIKE THIS NEWSLETTER? 💜

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your research and act responsibly with your profits.