THE MESS INTENSIFIES.

Tornado Cash crash continues echoing throughout the crypto sphere. New massive criminal investigations are on the way. But this time they’re aimed at new targets.

As the saying goes - a Crypto Owl Newsletter daily keeps the ignorance away. Let’s get to it.

🍝 SPAGHETTI: Do Kwon Speaks Out

🥞 GOOD OL’ PANCAKES: New Criminal Investigations

🍲 HOT POT: New Tornado Cash Casualties

🍩 DOUGHNUT: ETH Hits $2K

🍬 SOMETHING SWEET: Top Crypto News

DO KWON TELLS HIS PART OF THE STORY (SORTA)

Do Kwon faced the camera and the microphone with sharing his perspective. But there’s a catch. The interview was filmed (and is about to be posted) by Coinage media. A relatively unknown media outlet (they have around 5k followers on Twitter).

And the interview was conducted by Zack Guzmán, a relatively unknown journalist. Despite Coinage media only posting a teaser for the upcoming interview (scheduled to be uploaded on Monday, August 15, it was delayed due to unforeseen ‘minor export issues’). And this alone was enough to cause a fiery reaction on Twitter.

For example, a Twitter personality @FatManTerra, who claims to be an insider on the Terra project and has leaked many inside documents during and after the collapse of the Terra ecosystem, had something to say:

“Do, why not have an interview with someone more neutral and respectable like Bloomberg or Fortune instead of someone who has been consistently shilling you for *years*, almost as if he’s paid? And will you address the billions you cashed out of the system?”

So, FatMan accused Do Kwon of pulling yet another trick to try to redeem his image and begin something like a redemption arc of a villain to change the public’s perception of him. And if you look closely at the teaser, it honestly sounds… hmmm… biased. Here’s what Do Kwon says during the teaser:

“Terra was supposed to be a stablecoin, and it didn’t remain stable. Therefore, it must be a fraud and must be scam. Crypto is still sort of like the wild wild west. I think I developed like a sort of an alter ego.”

Or, when Do Kwon gets asked if he cringes at his previous ego-induced comments, here’s what he has to say:

“The algorithmic stablecoin was starting to become industry standard. I bet big, and I think I lost.”

These little fragments of the upcoming interview already paint an image of someone who was a human, too, with all the human flaws that all of us have. Yet… The twitter critics have a point when they say that, unlike most of us, Do Kwon is responsible for, as FatMan put it, “Developing an open-source permissionless protocol that bad actors unrelated to you used gets you arrested. Intentionally recreating a failed model, soliciting retirees and savers through false advertising & constant lies, and defrauding innocents of millions”.

NEW INVESTIGATIONS ARE ON THEIR WAY (POSSIBLY?)

Crypto exchange Bitfinex may be the next big name that’s about to face a possible criminal investigation in the U.S., judging from the Department of Justice (DOJ) reply to a Freedom of Information Act (FOIA) request shared on Twitter late Wednesday.

According to the document, The DOJ declined a request for information about Tether Holdings Limited, its parent company iFinex Inc., and what’s even more, its subsidiaries., which include Bitfinex. The exemption prevents the disclosure of "records or information compiled for law enforcement purposes, but only to the extent that production of such law enforcement records or information ... could reasonably be expected to interfere with enforcement proceedings."

This means that… If such info is unavailable due to the obligation to prevent disclosure of information compiled for ‘law enforcement purposes... Something investigator is taking place at this very moment. According to Twitter user oleh86, this is what the request that has been denied looked like:

“Dear Sirs, Pursuant to Freedom of Information Act (FOIA), 5 U.S.C. § 552, I am hereby requesting any and all information in possession of the US Department of Justice on jointly and severally TETHER HOLDINGS LIMITED, TETHER LIMITED, TETHER INTERNATIONAL LIMITED, TETHER OPERATIONS LIMITED, IFINEX INC., BFXNA INC., and BFXWW INC.”

TORNADO CASH CLAIMS MORE CASUALTIES

So, this Twitter user called sassal.eth just tweeted that he got “blocked from using the official Aave front-end because someone sent 0.1 ETH to [their] address via Tornado Cash“. What does that mean?

Well, it looks like the collateral damage from the Tornado Cash crash is only about to intensify. Remember the news about anonymous Tornado Cash users trolling celebs by sending them 0.1 ETH to artificially expand the list of people involved with the TC?

The news about sassal.eth being blocked from a crypto-related website show how the industry reacts to anyone having connections with the sanctioned crypto mixer.

And there were way more wallets that interacted with Tornado Cash. And it looks like sassal.eth’s case is not going to be an exception, and we’re about to see wayyy more complaints about people being blocked from one site or another. Just because their wallet is now associated with the notorious website, it has already begun.

Major DeFi protocols of Ethereum have already started implementing limitations on wallet addresses that have interacted with Tornado Cash because of the US ban. Among these DeFi protocols are Uniswap, Aave, or Balancer.

So, naturally, this caused an outcry. Those who have received the anonymous 0.1 ETH donations have been dubbed as the victims of ‘dirty ETH’. That makes sense. They didn’t want it. Someone manually added them to the ‘evil list’ of people who ignore sanctions.

DeFi giants responded to this by acknowledging that these people were not malicious in any way. They just happened to receive the dirty ETH. The same Twitter user eventually tweeted out about having his Aave address unblocked, and, as his explanation goes, he believes that:

“I believe the unblock applies to everyone that was dusted with 0.1 ETH from TC the other day.”

ETHER RISES

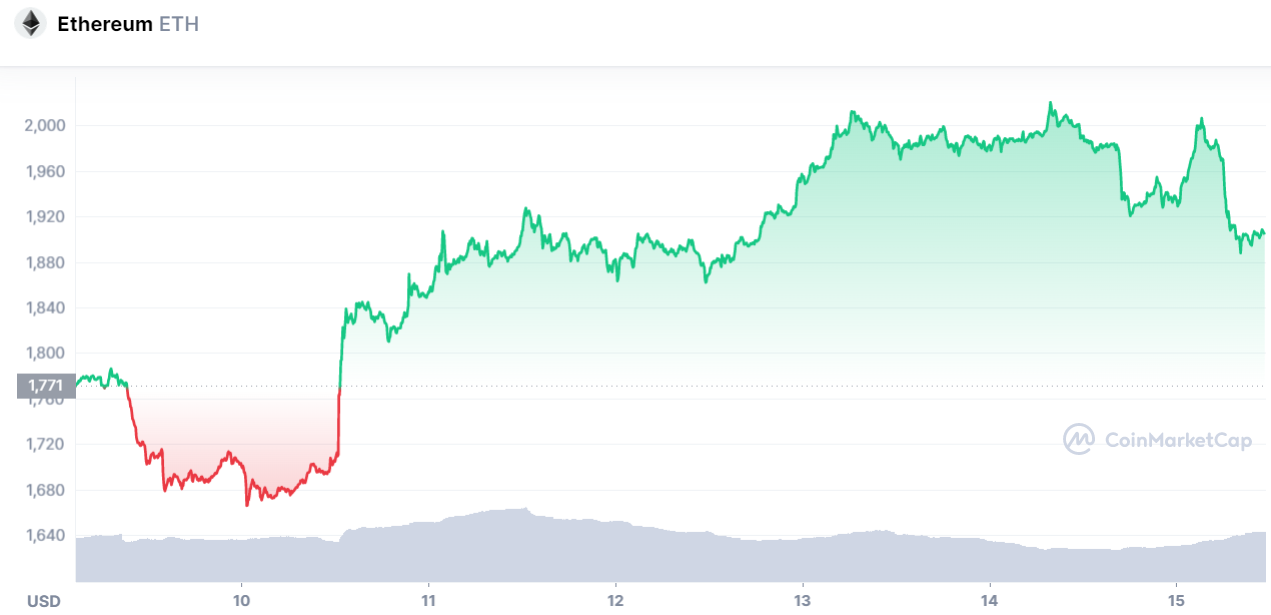

And now, to have a more positive closure, let’s look at something nice. ETH's price reflected their success after the triumphant updates about Ethereum completing its third and final test before actually getting it on with the Merge. During the weekend, ETH’s price hit $2k.

If you look at the chart, it’s not a brain-breaker to understand what was the day when the Goerli testnet took place. And so it happened that suddenly, ETH is all green. Well, the optimists have some ground for their sentiment.

The Merge is announced on September 19th of this year, and it’s getting closer and closer. People get interested, then they get invented. And then they buy some ETH with hopes of skyrocketing immediately after the day in question.

This may happen, and this may not occur. This is crypto, after all, and one thing is sure, nothing is certain. We will follow ETH’s journey towards its previous fame. Maybe we’ll get to witness it.

MORE CRYPTO NEWS AROUND THE WEB

Scaramucci Highlights Key Factors Why Crypto Market Will Soon Recover

Ethereum Hits 8-Month Highs In Btc As Money Heads For ‘riskier’ Altcoins

Shiba Inu Eyes 50% Rally As Shib Price Enters ‘cup-And-Handle’ Breakout Mode

Axie Infinity Cuts Rewards From Classic Game, Subtly Forcing P2e Players To New Mode

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your research and act responsibly with your profits.