THIS WEEK IS GOING TO BE INSANE FOR BITCOIN

Another legal action - this time against Yuga Labs. Could the Ethereum Merge be an actual threat to Bitcoin?

Coo! It’s me again, Crypto Owl! This Monday is National Carousel Day, so let's spin all together in the carousel of crypto news.

On Today’s Menu:

🍛 CURRY AND RICE: Is Bitcoin Ready For A Rollercoaster?

🍣 SUSHI BY YOUR CHOICE: Yuga Labs Falsely Promoted BAYC NFTs And ApeCoin?

🧋 BUBBLE TEA: Ethereum Merge Threats For Bitcoin

RESTLESS WEEK: BITCOIN, PLEASE, DON’T FALL DOWN

July is going to an end. And, it’s a lots-of-patience-requiring situation for the crypto community. We are all hoping to see that Bitcoin is going to close this month staying in a green zone. But… signs are not looking that great.

At first, last week seemed successful after Bitcoin hit the highest price since mid-June (it reached more than $23K on Friday). However, the week closed under the 200-SMA, which is a bad and bearish sign. And… on top of that, we’re entering a new week with A LOT OF decisive events for Bitcoin. Let’s take a look.

Tomorrow (26th of July), Microsoft and Alphabet are going to announce their earnings data. There is no surprise that the crypto market (Bitcoin market especially) is very dependable on tech markets (you could’ve noticed that during this bear market very clearly). So, after this announcement, Bitcoin is going to react one way or another for sure. Altcoins might follow.

On Wednesday (27th of July), the FED will announce the interest rate decision. Depending on it, volatility risk in the markets could increase. It is possible that FED will not raise inflation rates even more, but it’s a long shot.

Moreover, Meta is also going to announce its earnings on the same day. It could also lead to massive ups and downs. Let’s keep our fingers (or wings) crossed for the best.

Thursday (28th of July) is also going to be fun. Apple and Amazon are both going to announce their earnings, as well as we are going to find out the US Q2 GDP rate. Do you feel the tension? At least, I reaaally do.

Last but not least, on Friday (29th of July), we’re going to get the PCE Price Index data which also captures inflation or deflation and reflects changes in consumers’ behavior. So, it also might have some affection for Bitcoin and altcoins.

So, the Bitcoin price swings are probably going to be massive. And it starts tomorrow - stay tuned for the news!

YUGA LABS MIGHT BE ON THE OTHER SIDE OF THE COURTROOM

Last week we wrote about the SEC getting crypto bull strategies at their horns. Now, the law firm Scott+Scott organizes (it’s not official yet) a class-action suit against the number-one NFTs company. According to this lawsuit, it is possible, that Yuga Labs, using celebrities and other influential participants, promoted the BAYC NFTs collection (10,000 unique apes) and their native Apecoin token falsely to “unsuspecting investors”.

The key point in all this situation is whether BAYC NFTs are securities or not. At the moment, BAYC NFTs are not recognized as securities. However, if apes’ NFTs are recognized as securities, it means that they create a value, similar to having shares in a company: they would be treated like actual artworks or sculptures, with expectations to increase in price over time.

In that case, Yuga Labs might have a problem because the company hasn’t done any mandatory registration obligations due to the securities - NFTs - they offer. And, both BAYC NFTs and ApeCoin's values dropped greatly over the last few months.

The one who gets to decide if the asset is a security or not is the Securities and Exchange Commission (SEC). And, according to professor of law Brian Fyre, the SEC is actually not really into this idea of calling NFTs securities: “I see very, very, very little likelihood that the SEC is going to want to step in there and ... characterize that [Bored Ape NFT collection] as a security.”

That would mean excessive surveillance and job for the SEC because they’ve been avoiding a broader market of arts on their horizon. Fyre said, “that would open up a huge can of worms for them and force them to regulate all manner of other things that they don’t want to be regulating.”

So… can we say that Yuga Labs are safe, at least for now? Maybe. Even if SEC would decide to make BAYC NFTs securities, it’s going to be a long process and after this, a long battle.

ApeCoin is another target being recognized as Yuga Labs security. And, Fyre says that SEC could be “saying that [ApeCoin] looks a lot like a share in a business.” Why? ApeCoin, as a native token of Yuga Labs and BAYC, is guaranteeing the ability to vote on various government-related proposals of ApeCoin DAO that is based on the whole BAYC ecosystem. And on top of that, ApeCoin’s value fluctuates depending on BAYC and Yuga Labs’ fortunes.

Will this motivate the SEC to finally make up its mind and take action? Honestly, I have little expectations, however, I’ll be there to inform you with furthermore information when it comes my way.

THE ETHEREUM MERGE: A THREAT FOR BITCOIN?

September is going to be an important month for all of us for two reasons: 1) the ability to listen to Earth, Wind & Fire song September for 30 days non-stop; 2) Ethereum Merge.

The second event is going to be a huge historical event that might change the crypto game for many of us. But that could affect Bitcoin in a bad way.

The Merge should transform Ethereum’s monetary policy: it would make ETH more scarce, environmentally sustainable, and reduced in total supply. On top of that, ETH should be less inflationary than Bitcoin.

So… combining this all together, Ethereum could take over the number-one Bitcoin.

Ethereum researcher Vivek Raman said that Bitcoin is going to stay a digital gold, but Ethereum will still have a larger adoption space. So that’s a 1:0 to ETH.

But you know, I would say, let’s wait for September first. After the Merge is actually here - then we can talk about gold and silver medals.

MORE CRYPTO NEWS AROUND THE GLOBE

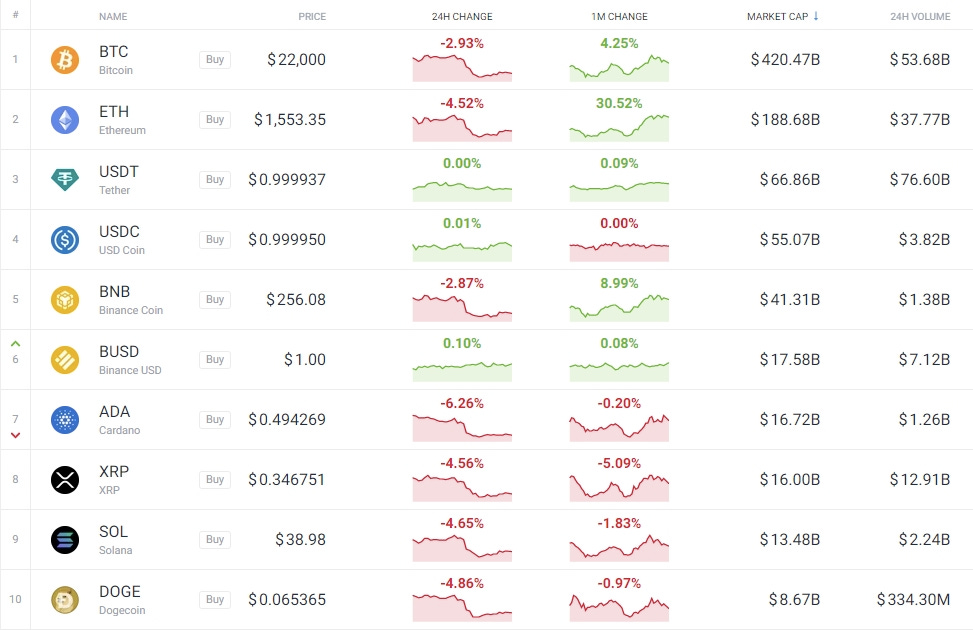

CHART OF THE DAY

FORTUNE COOKIE

💜Did you like this newsletter ?💜

With your feedback, we can improve it. Click on a link to vote:

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your own research and act responsibly with your profits.