UNISWAP SUFFERED FROM A PHISHING ATTACK!!!

But that's not all. Voyager Digital breaks promises, and 3AC founders went missing.

Coo! It’s me, Crypto Owl. Are you ready for some insane crypto news this Tuesday? Let’s go!

On Today’s Menu:

🦞️LOBSTER: Uniswap faced the phishing attack and lost almost $5 million

🥦STEAMED BROCCOLI: Voyager Digital can not keep its promises to customers?

🍢 LITTLE SNACKS: Where the hell is 3AC founders?

UNISWAP FACED THE PHISHING ATTACK AND LOST ALMOST $5 MILLION (OR MORE)

Uhhh, crazy.

Uniswap is one of the most popular and widely-used decentralized crypto exchange platforms, where you can swap, earn and trade crypto.

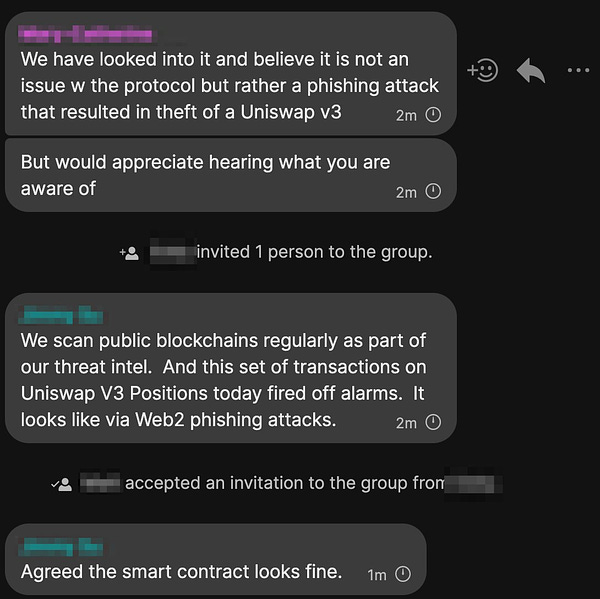

And just recently it was attacked. At first, it looked like a hack, but soon enough it was reported that Uniswap Protocol is safe. The attack was a result of a phishing campaign.

But let’s look closer at the details step by step:

One of the first, who noticed something wrong was happening, was Metamask security researcher Harry Denley. On the 11th of July, he tweeted that 73,399 addresses of Uniswap had been sent malicious tokens to steal people’s assets.

Tokens were called “UniswapLP” and the name made it look like a legitimate token from the actual “Uniswap V3:positions NFT” contract;

Those “new” tokens have probably attracted users' attention. Free tokens? Thanks!

Users, who decided to swap “UniswapLP” tokens for Uniswap native tokens “UNI”, probably sent their addresses straight to attackers' hands;

When you have a wallet address, is more than easy to drain it;

In some sources it is stated that at least $4.7 million in ETH has been stolen, however, the are lots of other reports noting that losses could be even bigger;

People from the community say that more than $9 million has been lost, and one of the prominent crypto users on Twitter suspects that a “large LP” with more than 16k ETH (worth around $17.5 million) possibly could have been also phished. Ouch, that would be painful for sure.

I wish this attack will be stopped and lost funds will be returned to the users. I’ll come back with more important details if any new will appear.

VOYAGER DIGITAL CAN NOT KEEP ITS PROMISES TO CUSTOMERS?

Here we are, coming back to crypto exchanges and their non-ending problems. This time it’s (again) Voyager Digital.

In previous newsletters, I wrote about Voyager Digital filing for bankruptcy. Nonetheless, the crypto exchange company had a recovery plan, where it aimed to preserve customers' assets and return equivalent funds to the users that were affected.

Those funds would contain Voyager tokens, cryptocurrencies, “common shares in the newly reorganized company”, and funds from proceedings with 3AC (The Three Arrows Capital).

An important detail is that 3AC was a firm that borrowed $650 million (containing 15,250 Bitcoin and 350 million USD Coin) from Voyager Digital, though it failed to repay.

Do you see the connection here? Some of the money that should be repaid to affected customers comes from proceedings with 3AC. Obviously, something is not working. But why?

Voyager Digital changed its statement. Now, according to the information on their website, the exact amount of lost funds will depend on “the restructuring process and the recovery of 3AC assets”.

What does that mean? It is possible that not all users might get back the amount of money they’ve lost because it’s not clear at all whether Voyager fix its problems with 3AC or not. Because if not, a lot of customers will have a bad day.

WHERE THE HELL IS 3AC FOUNDERS?

Since I was talking about crypto exchanges, and have mentioned specifically 3AC (coincidence?), let’s continue about them.

Interesting things are going on. The Singapore-based 3AC was the first fallen crypto fund (it filed for bankruptcy last month in order to protect foreign companies’ assets from creditors in the US).

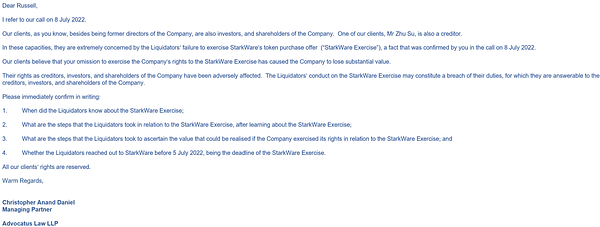

As I’ve mentioned before, 3AC was unable to repay its debt for Voyager Digital; but 3AC also failed to repay $270 million to crypto exchange Blockchain.com. So, A British Virgin Islands court charged business management company Teneo to oversee 3AC’s liquidation.

However, it was unsuccessful.

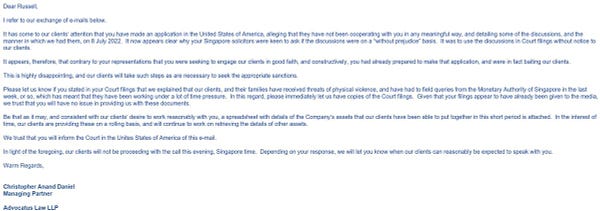

Tineo’s executive directors, Russell Crumpler, and Christopher Farmer announced that they have been unable to reach or contact 3AC founders Su Zhu and Kyle Davies. Their whereabouts are unclear.

In a court filing, Teneos’ representatives claimed that the best they could do was to make a Zoom call with persons who probably only faked to be Zhu and Davies because the video was off, and the sound was muted. “3AC founders” communicated via their own representatives from a Singapore-based legal agency. So, it’s nothing.

Christopher Farmer tried to find founders at the 3AC headquarters, but what he found was a pile of old unopened mail and a locked door. Neighbors said that no one had been there in the offices since late May or early June. Nice.

It is obvious that Zhu and Davies hide something. Community suspect that founders could just run away and vanish with the company’s cryptocurrency assets.

I hope founders will be found in the nearest future and stand in court for their actions.

⚠️ UPDATED WHILE WRITING ⚠️

Zhu Su appeared on Twitter with allegations against the liquidators. Well, that’s actually pretty funny, because Su and Davies are playing the victims now, after being silent for almost a month. Su says that their “good faith to cooperate with Liquidators was met with baiting”. What good faith, Su?

Check this out:

MEME OF THE DAY

MORE CRYPTO NEWS AROUND THE WEB:

GLASS OF WINE

💜Did you like this newsletter ?💜

With your feedback, we can improve it. Click on a link to vote:

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your own research and act responsibly with your profits.