CRYPTO EXCHANGES REVISIT COURTROOMS

Celsius is trying to get back lost money. Coinbase gets another filed lawsuit. American parents would like their children to be taught crypto at school. Facebook’s troubles. John McAfee is alive?

Coo, crypto friends! It’s me, Crypto Owl! Question: do you like peach pie? If so, it’s excellent; plus, today is National Peach Pie Day, so I promise you that Wednesday’s news will be as delicious as a peach pie. Let’s go!

On Today’s Menu:

🥕HUMMUS WITH LITTLE CARROTS ON THE SIDE: Celsius Adventures In Court

🥗 GREEK SALAD: Coinbase is Dealing With Another Lawsuit

🥣 LENTIL SOUP: More And More Parents Want Their Children To Be Crypto-Educated At Schools

🥘 FALAFEL WITH TZATZIKI SAUCE: Today’s Facts

🥮PEACH PIE: More Crypto News Around The Web

CELSIUS ADVENTURES CONTINUES IN COURT

This time Celsius is the one who’s filing lawsuits and trying to fight for justice.

I’ll start with the “Celsius vs. KeyFi” situation:

July 7th. DeFi protocol KeyFi, which was a DeFi associate providing Celsius with staking services and DeFi strategy, sues Celsius for not keeping the “handshake agreement” of profit-sharing; KeyFi accused Celsius of being a Ponzi scheme and claimed that their agreement was worth millions of dollars;

One week later (July 14th). Celsius reportedly files for bankruptcy. All the vast drama loop continues to grow; Want more details? Read here and here;

Now, Celsius sues KeyFi back along with protocol’s CEO Jason Stone. Is that matter of revenge?

Celsius claims that KeyFi had lost Celsius coins, and the reason for that was incompetence (apparently, Stone stated that he is an expert in DeFi, but Celsius argues that he is sooo not).

So, in this suit, Celsius notes that KeyFi stole millions of dollars in coins from Celsius wallets and, on top of that, bought NFTs with those coins without Celsius’ authorization; later, these NFTs must be transferred to Keyfi’s wallets.

It is also claimed that the defendants bought other assets using crypto mixer Tornado Cash, which is now evidently cursed with a mark of Cain and dealing with its problems (more information here and here.)

According to the suit, the defendants hadn’t returned funds as they were asked to.

And now it all leads to countersuing.

I guess this is not the end, so I’ll be there to inform you with further information.

But guess what - that’s not the only courtroom story.

The second one is about “Celsius vs. Prime Trust”.

And we’re talking here about $17 million worth of cryptocurrency that had not been returned to Celsius. Whoops.

And allegedly, Prime Trust, the custodian, representing itself as “powering innovation in the digital economy”, had to return those assets in June 2021 as the company broke its colleagues-relationship with Celsius.

Celsius's legal team said in a filed lawsuit, “Upon the commencement of these bankruptcy proceedings, Prime Trust was obligated under the Bankruptcy Code to deliver all property belonging to Celsius that is in Prime Trust’s possession to Celsius, including these remaining crypto assets, and should be ordered to turn them over now pursuant to section 542 of the Bankruptcy Code”.

One way or another, that’s A LOT OF money.

To my mind, with these lawsuits, Celsius is trying to get back not only money but dignity too. Especially after everything that happened.

COINBASE IS DEALING WITH ANOTHER LAWSUIT

Busy days for courts, I guess.

Nonetheless, it’s not the first time Coinbase has been sued for misbehavior. The previous incident is about illegal inside trading, and if you’re interested, you’ll find everything here about it.

A very unsatisfied customer, George Kattula (individually and “on behalf of all others similarly situated”, which is more than 100 people), is suing the biggest crypto exchange in the US for improper security regulations and for too long-locked assets.

In a lawsuit, it says:

“Contrary to its representations, Coinbase does not properly employ standard practices to keep consumers’ accounts secure <...> Coinbase improperly and unreasonably locks out its consumers from accessing their accounts and funds, either for extended periods of time or permanently.”

It is also mentioning “losses arising from unauthorized transfer of assets <...> including “crypto” securities listed on Coinbase’s platform without a registration statement”.

More to it:

Good luck, Coinbase; you’re going to need it. Also - not cool.

MORE AND MORE PARENTS WANT THEIR CHILDREN TO BE CRYPTO-EDUCATED AT SCHOOLS

Hurray!

Crypto is a future, just like in the past, the Internet was. And modern parents know it.

Study.com surveyed more than 800 American parents. The results showed that parents who are into crypto (invested or interested in NFTs, blockchain, metaverse, etc.) also want their children to be educated on this topic. So, parents who invest in crypto made up 68% of all respondents.

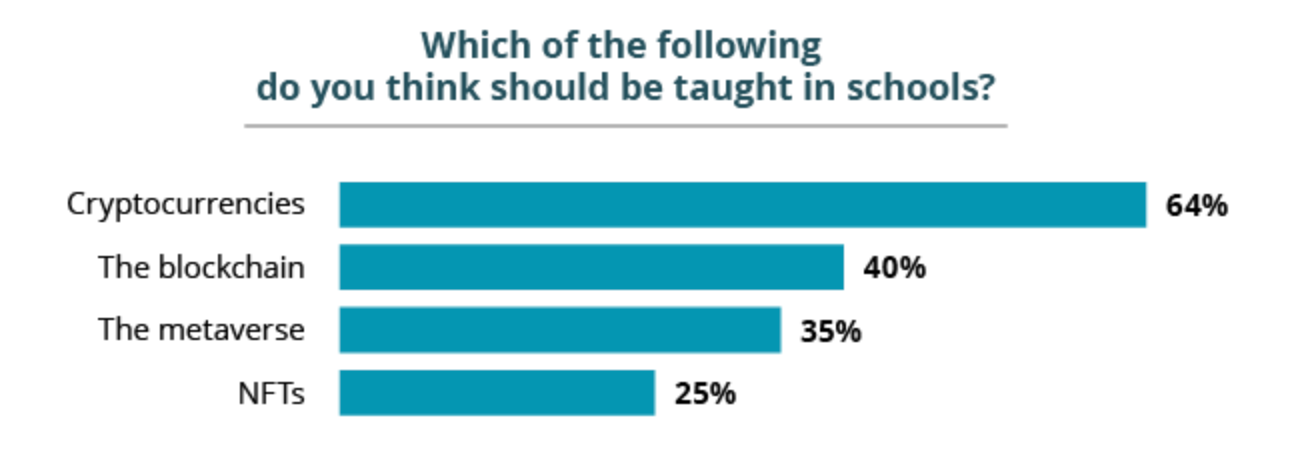

As you can see, the most desired topic to be taught at schools, according to parents’ answers (64%), is cryptocurrencies. So it’s a very similar percentage to parents investing in that.

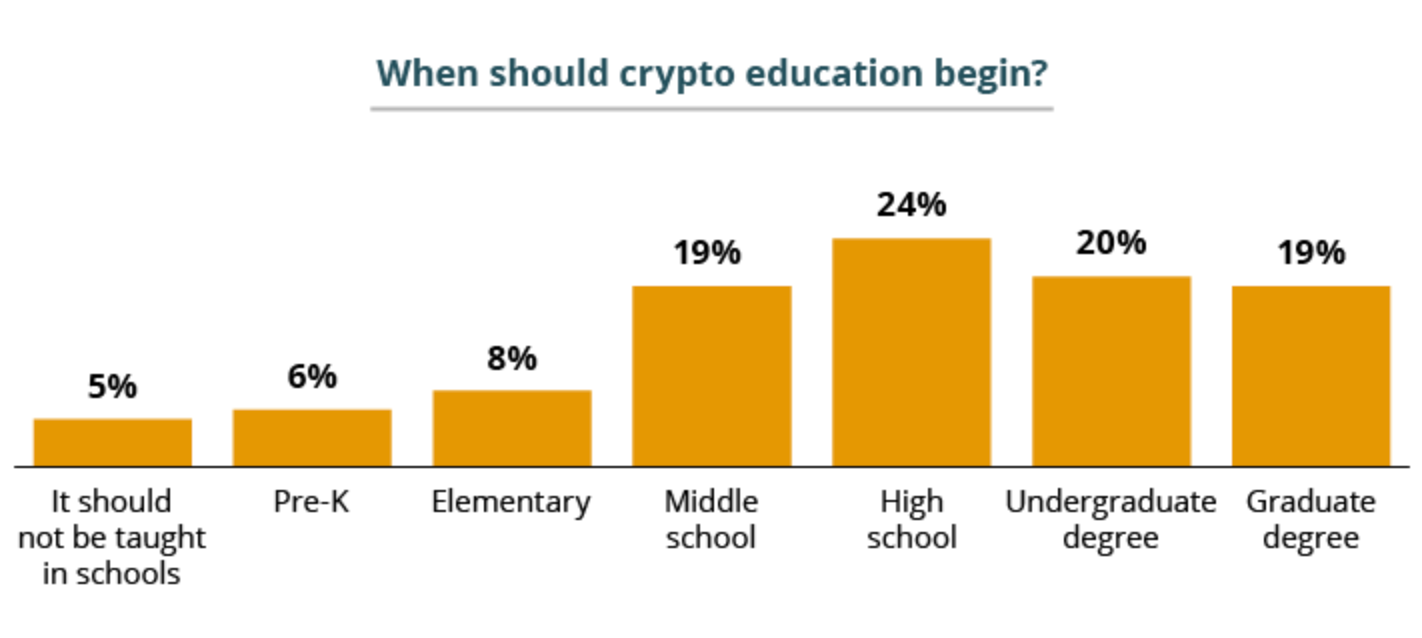

What’s more? 24% of respondents said that crypto education should begin in high school.

Now I’m interested in your opinion - would you agree that crypto is the topic that should be involved in the school curriculum?

WEDNESDAY’S FACTS

I have three. In my opinion, one is pretty funny; the second one is more casual; the third one has detective vibes.

A pretty funny fact: Facebook is going crazy today. It was bugged, and now everyone’s feed is full of comments from random people on celebrities' walls.

More-casual fact: Earlier this month, Mastercard and Binance collaborated and now are creating a card, so people could spend their cryptos just as easily as they would spend fiat currency using a credit card. Today, Mastercard's CEO announced that customers will be able to use this card in more than 90 MILLION stores! So, an idea fastly becomes an actual real thing. Moreover, the current Binance card is Visa, and it works successfully. So it will obviously work as Mastercard because people can use both almost anywhere globally. Overall, that’s fascinating. Honestly.

Detective-vibes fact: remember John McAfee? The one who created well-known anti-virus software called McAfee? And he was a crypto enthusiast too. However, in 2021, McAfee died in his cell (in Spain) after committing suicide. Now, his ex-girlfriend claims that John McAfee faked his death and is very alive and lives in Texas (I told you it has detective vibes). John’s wife (widow) has a different point of view:

MORE CRYPTO NEWS AROUND THE WEB

Australian Government Plans to Establish A Crypto Regulatory Framework

Uniswap eyes NFT financialization, in talks with lending protocols

Beijing announces two-year Metaverse innovation and development plan

LITTLE BIT OF RAKI

💜 HOW DID YOU LIKE THIS NEWSLETTER? 💜

Disclaimer: This newsletter is strictly educational. None of this information is intended to be financial advice. Always do your research and act responsibly with your profits.